cash app business account benefits

View transaction history manage your account and send payments. Ad Get 10 When You Sign Up For Venmo.

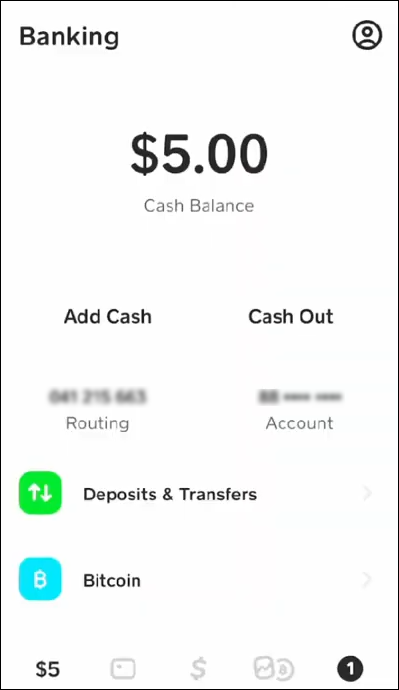

Cash App makes direct deposits available as soon as they are received up to two days earlier than many banks.

. Video Cash app business account benefits. 2 Cash App Business Account vs Personal Account Fees Limits. You can receive up to 25000 per direct deposit and up to 50000 in a 24-hour period.

Another advantage gained by eliminating the swipe is the fact that your customers payment information is. Anyone with a Cash App account can fund a nonprofit profile using a credit card or bank account. This facilitates online and long-distance payments greatly.

Financial accounts to fund. Chase Business Complete Checking has a 15 Monthly Service Fee unless you maintain a linked Chase Private Client Checking account are a current servicemember or veteran of our nations military with a valid military ID or proof of military service OR fulfill at least one of the following qualifying activities for each Chase Business Complete Checking account. Deposit paychecks tax returns and more to your Cash App balance using your account and routing number.

1 Cash App Business Account A Complete Detailed Guide 2022. Speed up your direct deposits. Request Sign In Code.

Financial institutions including Chase Bank of America Citi Wells Fargo American Express US. Sign in to Cash App. Your contactless business Mastercard will be with you in 3-5 business days once approved personalised with your business name.

Cash App does not offer live customer support and encourages users to report any issues including fraud and scams through the. Get 3 free ATM withdrawals per month when you. Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo.

The cashme link expands the functionality by allowing anyone to pay online using a credit or debit card. There are no fees for making payments when you connect Cash App to a bank account or debit card. Here are the top best Cash app business account benefits public topics compiled and compiled by our team.

Payments and Transfers Send faster payments from your business bank account from the Cashplus banking app or Online banking. Donors Spend More When They Use Credit Cards. Cash App also allows you to invest in stocks and Bitcoin.

Standard deposits go from your Cash App balance to your bank account while instant deposits go straight to your linked debit card. If you are so inclined you can invest in both stocks and cryptocurrency using your Cash App account. 1 most debit prepaid and credit card accounts issued by hundreds of US.

Youll be protected from fraud and identity theft. Sign in to your Cash App account. Credit card customers will pay a 3 fee whereas those who choose a bank account will pay a 4 charge but of course this will be charged to the recipient.

Cash App for Business accounts will receive a 1099-K form for those who accept over 20000 and more than 200 payments per calendar year cumulatively with Square. If you use Cash App for investing purposes this might amplify your concerns. Just Fill Out Your Info Mobile Number.

The Ingo Money App may be used by identity-verified customers to cash checks issued on US. If your taxpayer information is associated with Massachusetts Vermont Maryland Washington DC or Virginia we are required to issue a 1099-K and report to your state when you accept 600 or more. As mentioned above verifying your Cash App account will unlock additional features such as using a debit card setting up direct deposits transferring bitcoin and more.

The most common Cash App scams. Cash App offers standard and instant deposits. Customers with Cash App accounts can search your business by cashtag email address or phone number to send you a payment in the app or you can send requests to Cash App users.

Luckily for the tortoises among us there are no fees for standard deposits which take anywhere between 1-3 business days¹. With a Cash App account you can receive paychecks up to 2 days early. Youll enjoy additional features.

Here are just a few reasons. So why should you take the time to verify your Cash App account. Bank PNC Bank Capital One HSBC Bank USA TD Bank Discover.

One advantage here is that your customer doesnt need to be physically present in order to pay you. Cash App is a registered broker-dealer member FINRA and SIPC.

How To Add A Bank Account In The Cash App

Cash App Vs Venmo Which Is For You

Cash App Vs Venmo How They Compare Gobankingrates

How To Add Money To Your Cash App Card

How To Create Cash App Account In Nigeria Buy And Sell And Cash App Funds Premier Information And Tech How Tos Online

How To Login Cash App Account 1 855 908 5194 App Login Android Gadgets App

How To Add A Bank Account In The Cash App

Cash App Vs Venmo How They Compare Gobankingrates

How To Add A Bank Account In The Cash App

Scan To Pay Sign Venmo Cash App Paypal Sign Payment Sign Qr Code Sign Qr Code Display

Cash App Vs Venmo Which Is For You

Cash App Vs Venmo Which Is For You

How To Add A Bank Account In The Cash App

Noel Your Chance To Get 750 To Your Cash App Account Walmart 100

:max_bytes(150000):strip_icc()/Screenshot2021-11-09at11.35.14-7476aa727d4c4dae82727b2800eb6234.jpg)